In today’s data-driven financial environment, managing every cent is no longer a chore. Real-time dashboards are changing the way we view, manage, and improve our money, both at work and at home. These tools offer unprecedented clarity. You’ll instantly see your expenses, income, and investment returns. You will no longer have to wait for monthly statements or perform spending calculations. We live in an era where financial decisions can be made instantly, thanks to interactive dashboards that make money management simple and convenient.

Real-time tracking is at the heart of digital transformation. It gives consumers access to up-to-date information, clear charts, and in-depth statistics. Whether you’re a business owner monitoring your cash flow or an individual keeping track of your finances, these dashboards are scalable. They simplify budgeting, prevent overspending, and even assist with long-term wealth planning. Let’s see how these powerful tools are changing the way everyone manages their money.

Why Real-Time Dashboards Are the Future of Financial Management:

The old-fashioned way of managing your money is no longer enough. Spreadsheets and late bank statements simply don’t offer the speed and accuracy you need. Real-time dashboards give users instant access to income, expenses, debts, and assets. This helps people make smarter decisions, better track budgets, and respond more quickly to financial issues.

These platforms can often connect to multiple bank accounts, credit cards, wallets, and even business software. You don’t have to switch between apps or wait days for updates. Your dashboard shows every transaction instantly, so you can easily see trends, reduce unnecessary spending, and stay focused on your financial goals.

Benefits of Real-Time Dashboards:

These dashboards are unique because they combine a user-friendly interface with in-depth analytics. Most platforms allow you to customize widgets so you can see the information that matters most to you. Want to track your daily coffee expenses? Do you need to focus on your daily business expenses? The dashboard is just a few clicks away.

You can receive instant notifications about unusual transactions, low balances, or bills that are due. Smart categorization features show you where your money is going, such as food, transportation, subscriptions, and more. Artificial intelligence and machine learning often make dashboards more powerful, with predictions and suggestions to help you change your spending habits.

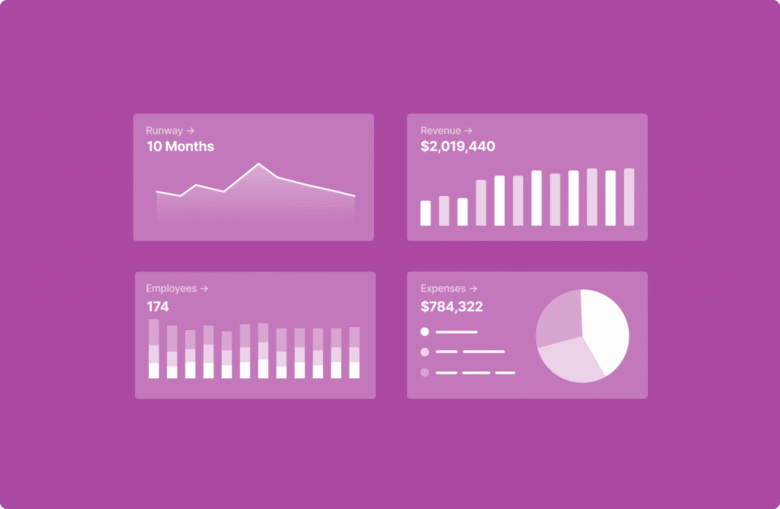

Data visualization is another major advantage. Pie charts, bar graphs, and trendlines make complex financial data easier to understand and process. Many dashboards also come with mobile apps, so you can keep track of your money, even on the go.

Real-Time Dashboards for Personal Finance: Take Control Like Never Before

Personal finance no longer relies on guesswork. Financial dashboards show users all their income, expenses, debts, and savings goals in real time. These dashboards give you a real-time view of your financial situation. Whether you want to buy a house, pay off student loans, or save for retirement, you can track your progress every day.

These apps can also help you automate your budget. Dashboards look at your historical spending patterns and generate a personalized monthly budget once you connect your bank accounts. You’ll receive notifications when you’re overspending and can adjust your budget mid-month if your priorities change. Plus, some apps can even predict your future balance based on current patterns and recurring expenses, so you’re always prepared for the next step.

Real-Time Financial Tools: Privacy and Security

Great power comes with great responsibility, and security is a crucial aspect. To keep your data safe, reputable dashboard providers use military-grade encryption, multi-factor authentication, and frequent audits. Users should always choose a platform with a strong privacy policy, a ban on data resale, and end-to-end encryption.

Most dashboards allow connected banks to view your data, but not transfer funds. This means that even in the event of a data breach, your money remains safe. Regular security upgrades and the ability to change privacy settings make everything even more secure.

Integrations That Make Dashboards More Effective:

The systems a dashboard connects to are essential to its usability. Real-time financial dashboards offer various interfaces, including banks, credit cards, CRMs, payroll systems, invoicing programs, and even tax tools. Such integration eliminates the need for manual data entry and gives you insight into your entire financial ecosystem.

Some systems enable organizations to use APIs to build their workflows and automate recurring processes, such as invoicing, financial reporting, or paying suppliers. This makes finances more transparent and ensures smoother workflows.

How Real-Time Dashboards Drive Smarter Financial Decisions:

Real-time dashboards give you the information you need to act quickly, because knowledge is power. Do you want to know whether you can afford a personal purchase or a business investment? Your dashboard will tell you instantly. You can make better financial decisions by focusing on your credit limit utilization, debt-to-income ratio, or monthly savings patterns in real time.

In addition, users can set, track, and modify financial goals based on their performance using the built-in goal-setting feature. Whether you want to save a certain amount each month, pay off credit card debt, or grow your wealth, your dashboard will keep you on track and motivated.

Conclusion:

Reactive money management is no longer an option. Real-time dashboards make it easy to track and manage all your finances. These systems offer a stylish, efficient, and powerful way to control your spending or improve your business’s cash flow.

As financial systems become increasingly complex, clear, up-to-date information is more important than ever. Dashboards can help you make data-driven decisions, so your money works for you, not you for your money. Embrace this shift in the digital world and start making smart, confident financial decisions today.

FAQs:

1. What is a real-time financial dashboard?

A real-time financial dashboard is a computer application that displays your income, expenses, investments, and savings visually and interactively, with real-time updates.

2. Are dashboards that provide real-time information secure?

Yes, the best platforms use strong encryption, two-factor authentication, and data security mechanisms to keep your financial data safe.

3. Can I use a real-time dashboard to track my finances, both for work and personal use?

Of course you can. Many dashboards are flexible enough for both personal and business users, with features to meet the needs of both.

4. Do I need extensive technical knowledge to use these dashboards?

Not at all. Most systems are user-friendly and easy to understand, with drag-and-drop widgets and clear visualizations.

5. How much does a real-time financial dashboard cost?

The price depends on the platform. Many dashboards have a free version with limited functionality, while premium subscriptions with more advanced tools cost between $5 and $50 per month, or more, depending on the provider.